The slowing down of the world economy is a big question in the Financial Market.

With an ongoing trade war between the world’s two largest countries – the United State and China, the world economy is on the stage of financial crisis for the first time in the last 17 years.

Nobel Laureate and “Irrational Exuberance” author Robert Shiller says, “I see bubbles everywhere in the financial market.” He has written a book on stock market crashes and bubbles.

Rober Shiller, an economics professor at Yale University and the author just published “Narrative Economics” told investors gathered in Los Angeles on 23 Oct 2019.

He said “there is no place to go. You just have to ride it out. You invest even though you know the expected price to be declined”. Robert has famously predicted the 2000 share market crash and 2007 is the crash of the housing market.

Shiller’s ominous warning time is a scary time. Last month was the 90th anniversary of Black Monday. On October 28, 1929, on that day, the Dow Jones Industrial Average fell 13%. It still stands as the second-worst decline in history, and it took 25 years for investors to recover from a mix of pounding stock markets in the early days of the depression.

Schiller sees bubbles in the stock market, bond market and housing market. “You get… in a situation when you know it’s going to happen, but you’ve still saved enough to save you; you have no choice.”

Shiller hopes Lackluster future US Stocks Returns

Shiller told investor’s Business Daily that he expects only 4.4% annual average returns in US stocks over the next 30 years. That’s a disappointing expectation – less than half of the markets long term return and less than what they are calling for pensions. The long term return of S&P 500’s is 9.84%, says Index fund advisors.

Problem? The stock market is largely valued as prices have risen a lot over the years. The stock market is up 348% since March 9, 2009, putting nearly $ 29 trillion in investors’ portfolios.

Shiller says that high valuation of rob future gains. He says the so-called cap ratio on US stocks is at a high of 29. The cap ratio, or cyclically adjusted price-to-earnings ratio, looks at how much investors are paying for inflation-adjusted earnings — the duration of the year. This indicator shows how expensive the market is, eliminating short-term distortions.

Shiller says” it happened a few times in history – a cape ratio is 29 currently. It happened in the mid-30s in 1929 so that was the record – Market subsequently crashed in 1929 and set off the great depression.

He says, however, that the CAPE ratio can still be high until an irrational exuberance bubble dissipates. “(CAPE ratio) went up to 45 in the year 2000 (before a 49% bear market decline from 2000 to 2002),” he said. But the CAPE ratio is slightly higher than in 1987, before the market’s largest one-day drop of 23% on October 19, 1987.

Recently, 57% from 2007 to 2009 before crushing the bear market? “In 2007 (the CAPE ratio) was around this level, just before the second crash,” he said. So “history suggests that (market valuation) can go up to 45, just what it did 20 years ago, or …” Give it half its value. “

Shiller – Bond market boom is non-sustainable

Schiller is as nervous about Bond as he is about the US Stocks. Bonds are one of the most asset classes, as investors seek income protection.

The SPDR Portfolio Aggregate Bond ETF (SPAB) gave a total return of 8.31% like this year. This is double the average annual return of 3.7% in the last 10 years. Investors are investing money into bond ETFs, hoping to hide from stock-market volatility and get at least some returns.

“It (bond bubble) seems related to not paying enough attention to people through simple logic … it can’t continue and it’s going to end badly,” he said. ” These things may sink at some point.”

Investors are buying negative bonds from outside of the US, they are making simply bet – they can sell bonds to someone else when interest rates go even more negative. They are holding the bonds until they mature locks in a negative return.

Shiller on Real Estate Market – It’s just like 2005 again.

Shiller says the real estate market is in a bubble phase the same as 2005 again. That was the point when the housing bubble was aerated, but yet to go parabolic. “It’s like 2005 again,” Shiller said. “San Francisco and L.A. are already slowing down.” This is a “bad indicator”, he said, as has been going on in those markets for years.

Real estate stocks have also caught fire. The Real Estate Select Sector ETF (XLRE) is up nearly 29% this year, giving the S&P 500 a 20% return. And this does not even include the market-beating yield of 2.8% of the real estate select sector. The real-estate stock technology select sector lagged behind the SPDR ETF (XLK) as the top-performing sector of the year.

Still, while the housing bubble in the early 2000s was not as “upbeat”, Shiller has so far hesitated to publicly call it a bubble. And he thinks enough people remember the 2000 housing bubble so they remember “house prices actually fall.” “We’re not that excited anymore, so I’m not sure it’s a double performance,” he said.

One Bright Spot: Europe

Schiller states that one place in the world shows such irrational exaggeration: Europe. Developed-world international stocks have largely survived the global boom. He sees European stocks almost a third cheaper than US stocks.

The Vanguard FTSE Developed Markets ETF (VEA) has given an average annual return of just 5.07% over the last 10 years. This is about half of the long-term expected return on international stocks. But investors are already investing. This year the Vanguard FTSE developed market ETF is 14%.

“He has a higher expectation for Europe than the U.S.”. He said.

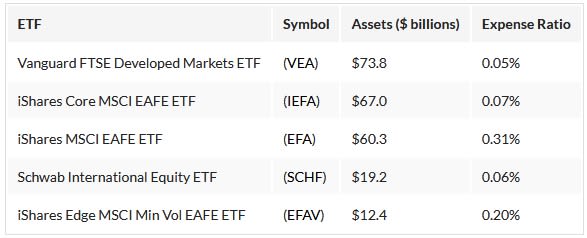

Escape the Bubbles? Largest International ETFs

Whenever you read a comment on Investor’s Business Daily, asking if the stock market crash is near, I can very much guarantee you it’s not near.

And Professor Shiller is not telling us anything new. There are bubbles everywhere in the market, including the private equity market, where performance is going down, not selling at a discount for the second time, and volatility is often underestimated even if alpha is longer than it is.

The interesting part of Schiller’s analysis, which I appreciate is that he expects only 4.4% average annual returns for US stocks over the next 30 years. That’s a really disappointing expectation – less than half of the markets long term return and less than what they are calling for pensions.

CalPERS’s CIO Ben Meng stated that private equity is the key to achieving the target of a 7% rate of return. It certainly is, but as I said above, there is also a bubble in private equity and expectations of return are diminishing as trillions fall into that asset class.

Meng also stated that they are long term investors in private equity not short-terms fixed on one, two or three years return.

This is why large investors like CPPIB are placing large bets on unlisted real estate and private loans to capture the long-term returns needed to achieve their targeted rate-of-return.

Still, it has taken me a long time to know when trillions fall into any asset class, including real estate and personal loans, with declining future returns.

Real estate is a function of interest rates and employment. With US rates and unemployment rates at record levels, it is no surprise that real estate has fared better this year.

If rates start decreasing rapidly and employment growth starts to decrease rapidly, then you will see that real estate will get hit.

But there is another channel where real estate (and private debt) can be found very difficult, the deflation channel. If we see that rates are falling, negative and the economy is declining because people have too much debt on their books, a debt-deflation spiral can easily develop and this real estate, Private debt will greatly affect all public and private property.

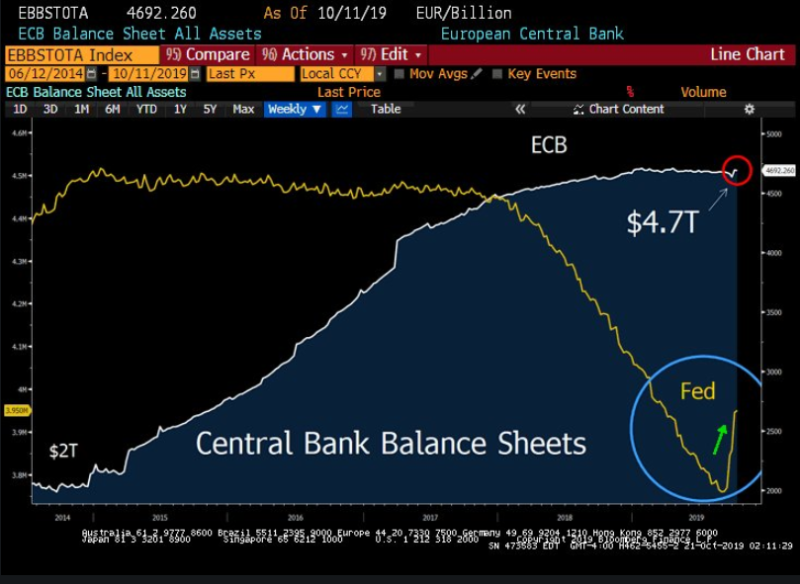

This is the reason why central banks are constantly entangling Qi or Quasi-Qi operations, forcing investors to risk curve ( while warning to access money for yields). Earlier this week, Mohammed Al-Arian posted this chart on LinkedIn:

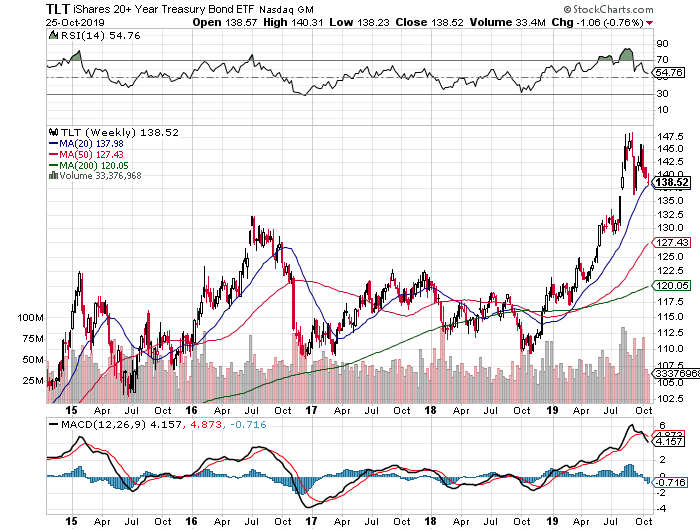

What about Schiller’s views on the bond market? He is not the only one who worried about the bond bubble. Louis-Vincent Gev, CEO and co-founder of Gawkley Research, thinks the bond market is the biggest bubble of our lifetime, and BCA Research’s chief global investment strategist, Peter Berezin, is warning investors that “own bonds” Would be quite painful “.

Take a look at the 5-year weekly chart [(TLT [NSD] – $ 135.00 trade)] of US long bond prices, the index is right on its 20-week moving average:

Prices may be lower and yields may be higher but for this to happen, we need to see a pick in the global PMI and I am not watching yet.

It is true that central banks have been relaxed, but there is too much debt which is hindering growth. So I have an expectation through the economy.

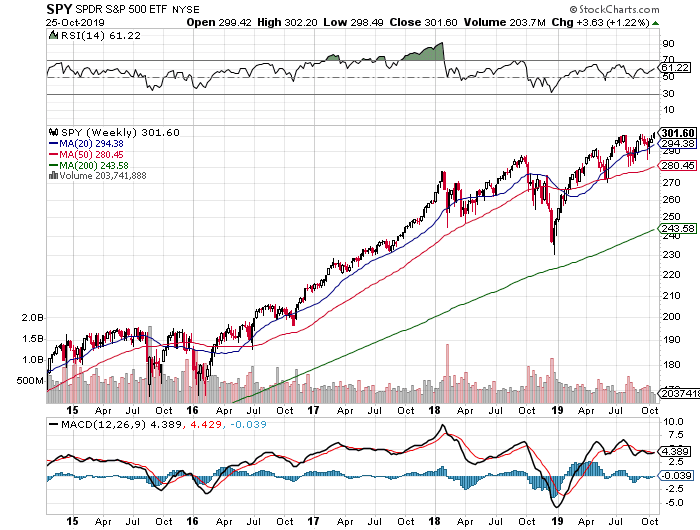

As far as stocks are concerned, my views have not changed since last week, the S&P 500 has gone above 3000 but there is a lot of panics:

Still, if it can hold these levels and finish the year near 20%, I’d say it’s a great year for stocks. As I said, I do not expect a year-end rally or meltdown and think it is best to focus on stock picking here compared to the overall index.

Below, the Nobel-Prize-winning economist Robert Shiller recently stated that the recession could be overcome due to the Trump effect of the market boom. Is a recession far and near a stock market crash? this is confusing!

Related:

1 Comment